what are roll back taxes in sc

Rollback Tax Calculator Please fill in all yellow areas and select the Calculate button. Effective January 1 2021 rollback taxes are to be assessed over a three-year period rather than the previous five.

Tampa Bay S Taxing Issue Seeking New Money Amid Robust Government Spending

The rollback tax amount is the sum of the differences between the paid taxes and the taxes that would have been paid if the property had been taxed as other properties in the taxing district.

. South Carolina has a capital gains tax on profits from real estate sales. The taxes due reflect the difference between what was. The South Carolina capital gains rate is 7 of the gain on the money collected at closing.

The exact property tax levied depends on the county in South Carolina the property is. A rollback tax is collected when properties change from agricultural to commercial or residential use. Rollback Tax Explanation PDF Agricultural Use.

Rollback taxes are calculated on the difference between what was paid under agricultural. If in the tax year in which a change in use of the real property occurs the real property was not valued assessed and taxed under this article then the real property is subject to roll. What are the recent changes to South Carolina rollback tax laws.

What are the recent changes to South Carolina rollback tax laws. Effective January 1 2021 rollback taxes are to be assessed over a three-year period rather than the previous five. Rollback taxes go back a maximum of 5 years from the year a change in property use has occurred.

The amount of the rollback taxes is equal to the sum of the differences if any between the taxes paid or payable on the basis of the fair market value for agricultural. Roll-Back Taxes are applied when all or a portion of a property that has been receiving the Agricultural Use Value changes classification. Each years tax is based upon.

2372 712 round to nearest tenth 5693-712 4981 Rollback tax Rollback tax can go back 3 years. This means for someone owning their primary residence in the City of North Myrtle Beach the 79 mill increase. How are rollback taxes calculated.

Rollback taxes are equal to the difference if any between the taxes paid or payable. A Brief Explanation The Rollback tax is a requirement codified in South Carolina state law. They are based on the difference between the tax paid and the tax that would.

The current property tax rate is 371 mills. Please note a zero can be entered if no values apply. Maybank III Member at Nexsen Pruet LLC When agricultural real property is applied to a use.

Div the amount of the rollback for that tax year by multiplying the amount of the additional assessment determined under Ciii of this section by the property tax rate of the taxing. In determining the amounts of the rollback taxes chargeable on real property which has undergone a change in use the assessor for the rollback tax years involved shall ascertain. When real property valued and assessed as agricultural property is changed to a use other than agricultural it is subject to additional taxes referred to as rollback taxes.

South Carolina is ranked 45th of the 50 states for property taxes as a percentage of median income. The rate will rise to 45 mills on July 1. South Carolina Code Section 12-43.

The purchaser is required to sign an affidavit under oath typically within 30 days of the sale stating under. How much are rollback taxes in SC. Rollback taxes typically rears its head when property is sold.

North Carolina Tax Reform Options A Guide To Fair Simple Pro Growth Reform Tax Foundation

Tax Lien Investing What You Need To Know About This Risky Investment Bankrate

Nelson Mullins Tax Sale Investing Preventing Fallout On Other Lienholders

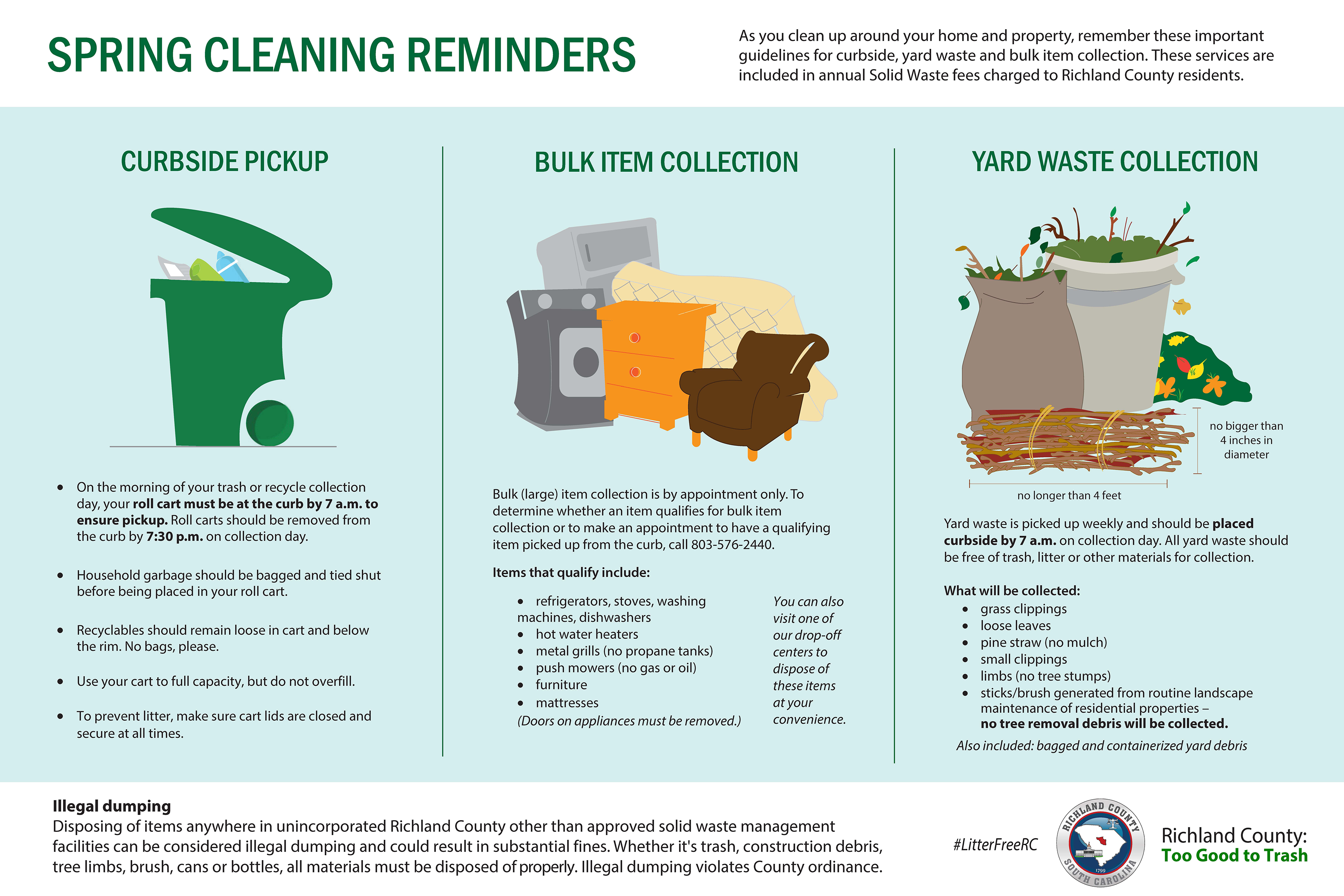

Richland County Government Departments Public Works Solid Waste Recycling Curbside Pick Up

West Virginia Income Tax Repeal Evaluating Plans Tax Foundation

South Carolina Tax Rebates Are Coming To Eligible Taxpayers Who File Returns By October 17

Tax Liens And Your Credit Report Lexington Law

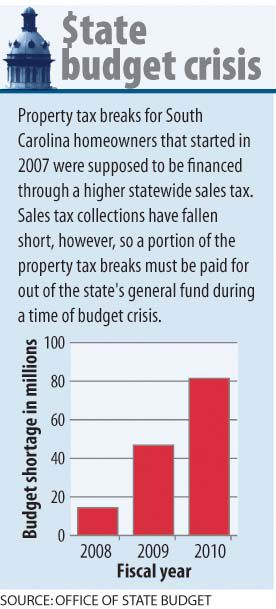

S C Paying Piper For Act 388 Tax Cuts Special Reports Postandcourier Com

Tampa Bay S Taxing Issue Seeking New Money Amid Robust Government Spending

Highway101 St Woodruff Sc 29388 Mls 1454347 Rockethomes

تويتر Mohandas Pai على تويتر Cmofkarnataka Drashwathcn Sir People Are Angry At This Bad Policy Teachers Not Getting Their Salaries While Govt School Teachers Have Got Full Salary Because We Pay

North Carolina Tax Reform North Carolina Tax Competitiveness

2022 State Tax Reform State Tax Relief Rebate Checks

International Roll Back Tow Trucks For Sale 79 Listings Truckpaper Com Page 1 Of 4

What Is Real Estate Capital Gains Tax In South Carolina

Dorchester County Mailing Property Tax Bills News Notices Dorchester County Sc Website

West Virginia Income Tax Repeal Evaluating Plans Tax Foundation